Content

You can check where you stand and how to enhance your company strategy by keeping track of your earnings and spending with the aid of bookkeeping. By monitoring your cash flow, you may securely make investments while being aware of your financial situation. Because real estate bookkeeping is our expertise, we work exclusively with real estate investors, including wholesalers, house flippers, landlords, realtors, and limited partner investors. We have over 20 years and over 40,000 clients behind our real estate expertise. No matter your size, volume, or business model, our experienced real estate accountants and bookkeepers will streamline your investing business, putting time and money back in your hands.

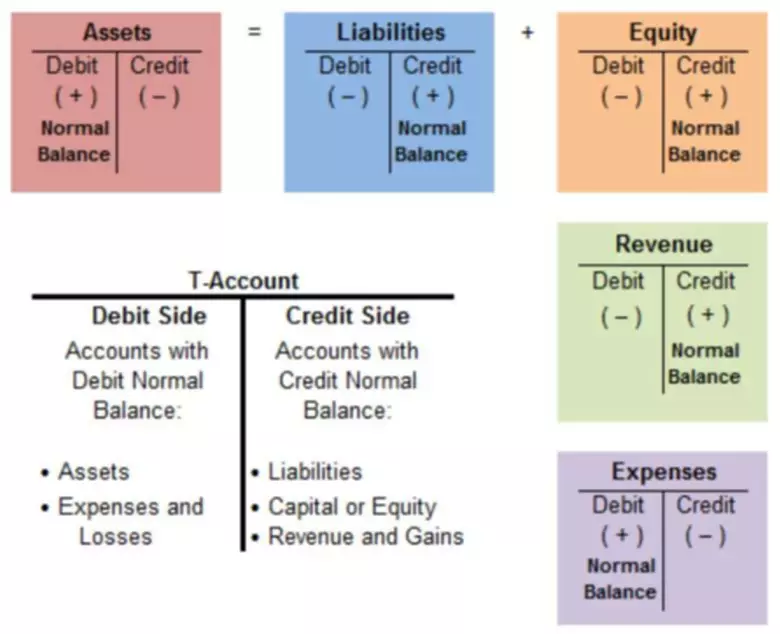

In short, we’ve been where you are, we know the industry, and we know the shortcuts to success. The rest of the expense transactions a typical real estate business is likely to incur are straightforward to record. Equity type accounts commonly represent your equity balance in your company.

SEARCH YOUR PROPERTY

She currently works on a wide-range of clients ranging from small landlords to syndicates and funds. However, because QuickBooks isn’t designed for property accounting, you’ll encounter a number of problematic limitations that require workarounds. If you just have a few properties and you’re mainly in need of an accounting solution, QuickBooks is a great starting point that you can grow into. Where it falls short is in a lack of a QuickBooks integration, which holds it back from being the ideal property accounting solution. Property accounting software often has fewer features than general accounting software.

A rental property accounting system like Stessa automatically tracks income and expenses and helps real estate investors to maximize revenue with personalized recommendations. With the improvements in today’s technology, real estate bookkeeping has gotten substantially easier to do the help of online resources. By law, it is required that businesses keep https://www.bookstime.com/ up-to-date and standardized records of all money going in and out of their company. Online bookkeeping keeps a more accurate track of daily expenses so that you have one less thing to worry about – similarly to the way a virtual assistant would be helpful. Recording rent received may depend on how you’re billing and receiving payments from customers.

Get all the resources to scale your property management business.

Significantly enhance the profitability of your real estate investment portfolio by using quality software and real estate bookkeeping best practices. You can learn more about our services by reading this site, plus check out our introduction to real estate bookkeeping webinar. With more than $4B in transactions under their belt, RealCount’s leadership team includes real estate veteran CEOs, developers, entrepreneurs, and investors.

Between terminology and the complex nature of numbers, accounting can get pushed to the side. Proper real estate bookkeeping is one of the most, if not the most, important factors of your business. If you want your company to grow and run smoothly, you need to stay on top of finances – business and personal. We provide tax planning and advisory services to real estate investors and businesses of all types. In fact, you not only get a full suite of property accounting features, you get a complete set of property management features to help make managing your properties simpler and easier. We offer onsite bookkeeping services for businesses in southeastern Wisconsin as well as nationwide remote services.

About REI Bookkeeping Babes

However, other common software programs likely have the same or similar features (just under different names). Most accounting software walks the user through the initial setup, but it never hurts real estate bookkeeping to understand the basics. While some investors keep hard copies, many other rental property owners scan and upload each document to a secure, cloud-based storage system on the internet.

Keeping your books straight is a very important part of any real estate business to ensure its financial success. So, properties, units, and sub-portfolios are supported out of the box without any special setup or accounting knowledge. When you activate accounting through RentRedi, we’ll automatically sync your properties and units to REI Hub for you.

Financial performance you can count on

The IRS and general accounting principles require the cost of the new roof to be spread out over that time. So you’ll record the expenditure to an asset category and not an expense category. Your CPA will then correctly depreciate the asset so the expense is spread out across the life of the asset. (Other software may call this feature by another name, such as Funds.) In QuickBooks, the Class field adds another space to additionally categorize a transaction. An expense transaction with Home Depot can be recorded to a universal category called Supplies.